Must put another type of bathroom to your house come early july? It might be time and energy to change that 20-year-old rooftop. Or a drooping foundation demands shoring.

Of many residents in this situation usually pick a home collateral mortgage to fund fixes otherwise improvements. Exactly what for individuals who use up all your household equity? Maybe you are underwater on the financial? Or you have a manufactured domestic otherwise property on hired home,

You might find let owing to a good HUD/FHA Term 1 domestic-improve mortgage . In place of domestic guarantee fund or lines of credit, new Identity step one program has no need for one provides built up any security of your property.

The fresh new no-guarantee situation

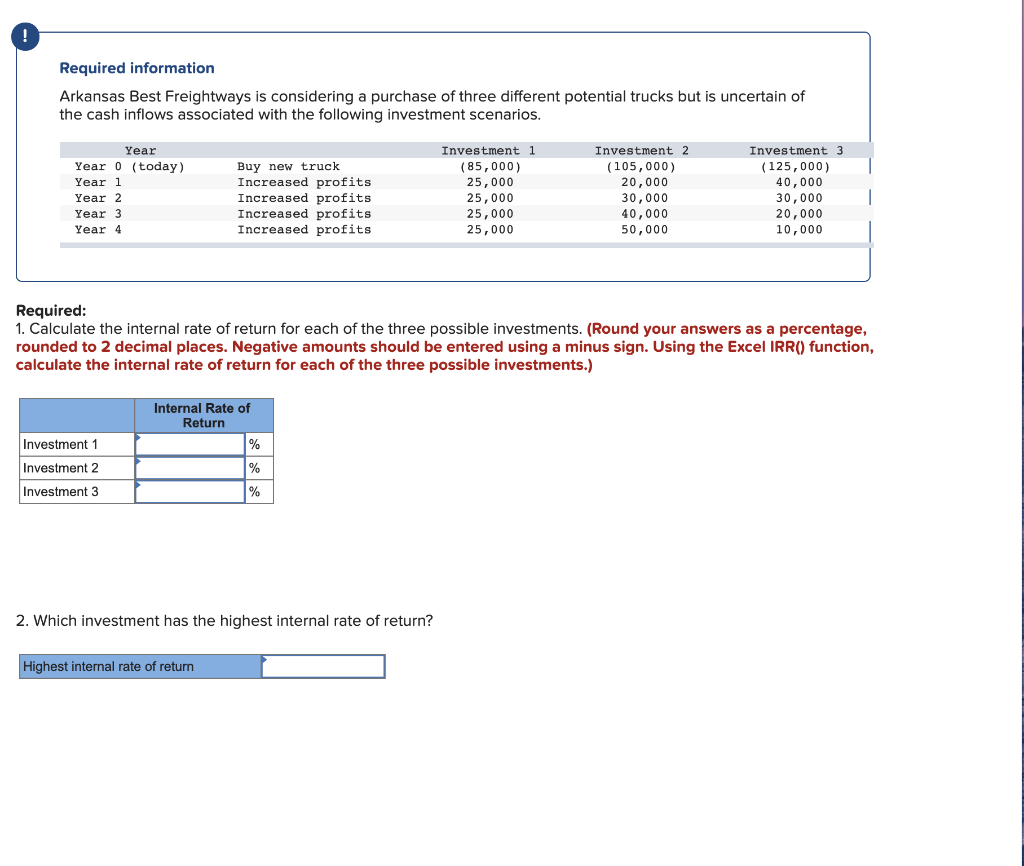

From the FHA Identity step 1 do-it-yourself loan program, homeowners is be eligible for repair loans as high as https://availableloan.net/payday-loans-ar/blue-mountain/ $25,000, without worrying in the whether they have enough collateral to take out property collateral loan or house collateral personal line of credit (HELOC).

Residents you prefer funds such as these as household re also Costs versus. Really worth declaration, Restorations Magazine asserted that it costs normally $44,233 to include your bathrooms to a property. Replacement a roof can cost you on average $20,142, while actually a relatively slight opportunity for example replacing a beneficial house’s exterior will cost you an average of $14,100.

Really home owners lack that sort of money sleeping doing. So that they have a tendency to seek out domestic guarantee fund, tapping this new security they usually have accumulated within house to possess financing that they can used to buy developments.

The challenge will come when residents don’t have any security inside their property. This is simply not you to uncommon. Of several exactly who bought inside the height of your houses growth is nevertheless “underwater” on the fund, owing regarding the mortgage loans than their houses was worth now. CoreLogic stated that regarding 4th one-fourth from 2015, 4.step 3 billion U.S. home owners was indeed negative equity. Which was 8.5 % of all of the mortgaged qualities.

FHA Label step one Do it yourself Loans

People can apply having Name step 1 loans to cover a selection of developments on the domestic, big or small. In the event your heater conks away, you could potentially sign up for a name step one loan to fund their replacement for. If you prefer a new roof charging $20,000, you can utilize a name step one mortgage to cover you to definitely, too.

Considering HUD (You.S. Agency regarding Homes and Metropolitan Innovation), you should use Identity step one financing to invest in permanent property improvements you to cover otherwise boost the livability otherwise capability of your house. This may involve required solutions eg repairing a sagging foundation otherwise alterations for example adding a 3rd bedroom as your family unit members grows.

Although not, you simply cannot fool around with Term step 1 money to possess deluxe products, eg creating an alternative spa otherwise share. It is best to speak to your bank to decide in case the structured project are greeting under the Name 1 system.

This type of loan is sensible proper trying out a beneficial unmarried, modest family-update investment. And it is a really good choice should your family has lost worthy of because you bought it. This is because you simply will not need to bother about reasonable otherwise negative guarantee when applying for such financing. Lenders don’t require you to appraisers regulate how far your home is well worth today just before granting your to possess a name 1 mortgage.

Bringing a title step one mortgage

These finance are available thanks to banking companies or any other creditors one to is actually HUD-approved Name step 1 loan providers (click the relationship to come across ones towards you). The fresh FHA (Federal Casing Management) cannot originate these types of funds myself. Prices and closing costs ong lenders.

According to Department off Houses and you may Urban Innovation, property owners got out 5,548 Label step 1 do it yourself financing inside financial season 2014.

If you’ve in earlier times applied for a mortgage, you happen to be currently always the program processes to have a name step 1 do it yourself loan. Their lender will run the credit and might ask for facts that you could pay off the loan timely. This may signify you will have to bring the bank having copies of present paycheck stubs, bank-membership statements, income-tax statements and you can W2 comments.

These are repaired-speed fund, which means that your own interest rate won’t vary throughout the years. Rates during these financing, just like having a simple financial, are very different depending on a host of points, such as the strength of your credit.

You might sign up for this type of finance getting a maximum title of twenty years getting single-loved ones land and you may multifamily characteristics, though you can put on to possess a smaller label, also. And don’t care about paying off the loan early; Identity 1 loans have zero prepayment punishment, in order to shell out in the event the out-of if in case you want instead delivering a monetary struck.

Lending limits into a title step 1 financing

When you find yourself Name step one funds don’t need any household equity up front, anything more than $eight,500 continues to be shielded of the security of your house. The utmost you might use will be based upon the fresh new questioned boost of your house well worth considering the developments.

To possess an individual-home, the maximum amount as possible borrow according to the Name 1 program is actually $25,000. If you find yourself dealing with a kitchen renovation that will set you back $fifty,one hundred thousand, you simply will not be able to money a full number of brand new jobs from the Identity step one program.

If you’d like to build reily strengthening, you can pull out a name 1 loan all the way to an average of $12,000 for every life unit doing all in all, $60,100.

No equity is necessary towards the a concept step 1 do-it-yourself loan from $seven,five hundred otherwise smaller, therefore the mortgage actually secured of the a home loan or deed from believe at your residence. This is a nice added bonus: If you cannot create your financing payments timely, for some reason, your own financial is not able to visit immediately following your residence.

In addition, it means you need to use a subject 1 mortgage to have short home improvements on dwellings that will be towards the rented house, such very are created land. Mainly because commonly believed home, it may be difficult to receive a house guarantee financing towards her or him.

However, by firmly taking away a subject step one financing for more than $eight,five hundred, the mortgage should be shielded by the family equity. If you do which, the bank can foreclose on the home if you don’t build your own monthly obligations.

Skriv et svar