Or even like automobile resolve finance, there is certainly an alternative choice you could prefer. There are some cash to possess vehicles repair investment of the asking for let. That is right. There is no shame and absolutely nothing wrong with requesting assist. The money isnt given out for your requirements. You are able to repay it punctually, on person who is assisting you. The advantage of it is that they would not inquire about extra charge and attention charges.

You can try and have that loan away from a member of family otherwise a buddy. You could potentially strategy all of them with a smart payment propose to persuade these to leave you a consumer loan. It may be tricky that will feel like a shameful flow possibly, you won’t need to worry until you has a substantial bundle that produces sure their relationship isnt stained.

Below are a few Auto Fix Insurance rates Choices

No matter if individuals will most likely not consider this much, insurance agencies are among the best choices for saving money getting automobile repairing. Before you can state I am unable to manage my car fixes,’ find out if maybe you are able cheaper payments such car insurance policies. Its significantly more good for shell out a lot less today right after which and now have your vehicle repaired if there is accidents. Spending for an expensive car resolve on your own is not a spending budget-amicable alternative.

You must be certain that high priced possessions in unanticipated affairs such vehicle injuries, thieves, otherwise automobile malfunctions. Insurance providers security the expense from car wreck, that may make it easier to can i get a payday loan if i am self employed once you don’t have the cash on hands to fund their car’s fixes. You should look for an insurance coverage organization which is designed towards the should prevent worry and you will a lot of expenses.

There are several positive points to build works together auto insurance team, like having your insurance policy the damage that have brief payments. It’s also possible to get automobile replaced in the event of thieves. But the downsides are you to insurance coverage owners may have to shell out deductibles before you make a claim. It might be smart to together with considered that insurance costs much more than accountability visibility, and you may premium increases once demands. However, members of AAA might find a trusting merchant who has the benefit of roadside assist. Having a merchant render crisis street features is extremely important in the matter-of a major accident.

Credit card Coverage

Making use of your credit card to fund solutions is fast and you will easy. Make sure you only use the mastercard to possess issues. Playing cards can help you with all of type of expenditures one to you want instant expenses, such medical care, an option to shed or busted facts, and additionally, automobile fixes. You are welcome to use your mastercard to repair instance small injuries because the windshield damage, cracks, dents, damaged windows, damaged headlights, paintwork, bonded bulbs on the back and you can front side of one’s car.

The most known advantages of credit card incorporate tend to be the opportunity so you can immediately pay for the auto resolve. No matter what contribution you will pay you might go back huge amounts of cash immediately just like the really. Prior to with your charge card due to the fact a payment means, thought that installments raise after each and every fee, while the lender can be continue repay day. Nevertheless, credit cards can come inside the convenient when you need them. However, just remember that , you are able to playing cards simply for problems to stop overspending.

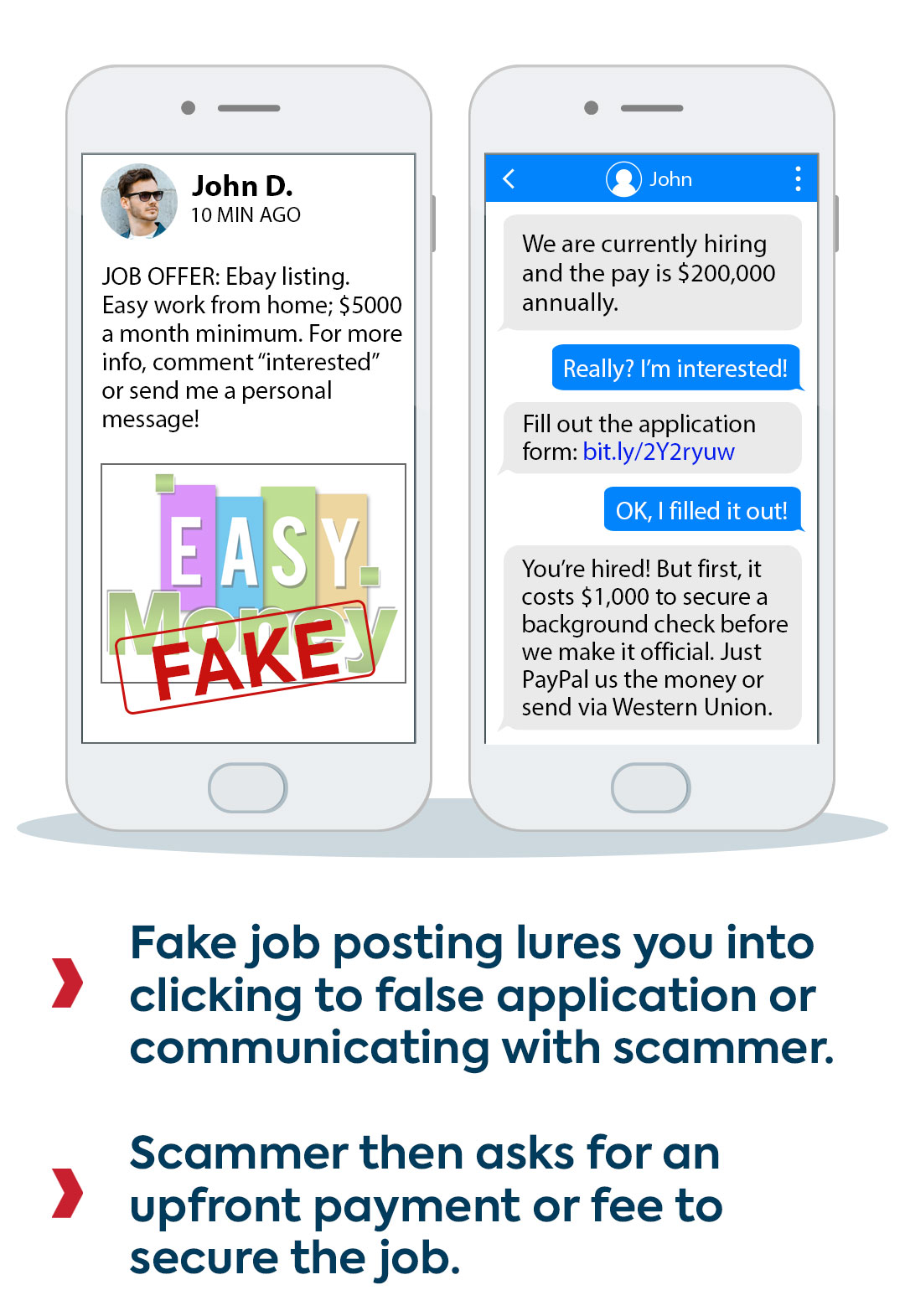

Warning: How to avoid Predatory Credit Practices

You are effect hopeless now, as well as your credit rating will be terrible. Even though here is the situation, don’t beat your own composure. You might be provided a title mortgage to take some automobile repair credit, which you can use to fix the car. you must be careful on the decision-making. There is a large number of companies online which use predatory techniques while offering label loans. Precisely what does predatory function? It indicates borrowing products with high cost you to target someone like you that simply don’t have many alternatives.

Skriv et svar