The common cost of a marriage enjoys ascending. The cost of wining and you will dining a couple group and two kits of family is commonly a major costs. Include formalwear, groups, plants, prefers and you will an effective rehearsal eating and keep an eye out during the thousands of bucks (or higher!). Particular partners possess discounts capable put to use otherwise well-heeled parents who will be happy to help out.

Relationship Funds: The fundamentals

A married relationship loan is actually an unsecured loan that is created specifically to pay for marriage-associated costs. If you’ve currently over specific wedding planning you’ll know that there is a huge up-costs getting whatever has the phrase wedding linked to they. A leg-duration white cocktail skirt might cost $2 hundred, but a knee-duration white skirt recharged given that wedding gowns? $800 or even more. An identical have a tendency to applies to unsecured loans.

After you start doing your research private money you can note that there are many loan providers on the market, from old-fashioned banks so you’re able to credit unions and you may fellow-to-peer financing web sites. All these features higher-interest-price choices. But is they wise to undertake these kinds of money? Most likely not.

Most of the debt are a threat. The greater the speed, the higher the chance. For those who need to have a wedding loan, it is very important not only search for low interest. It is best to find money that have low or zero charges, along with no prepayment penalty.

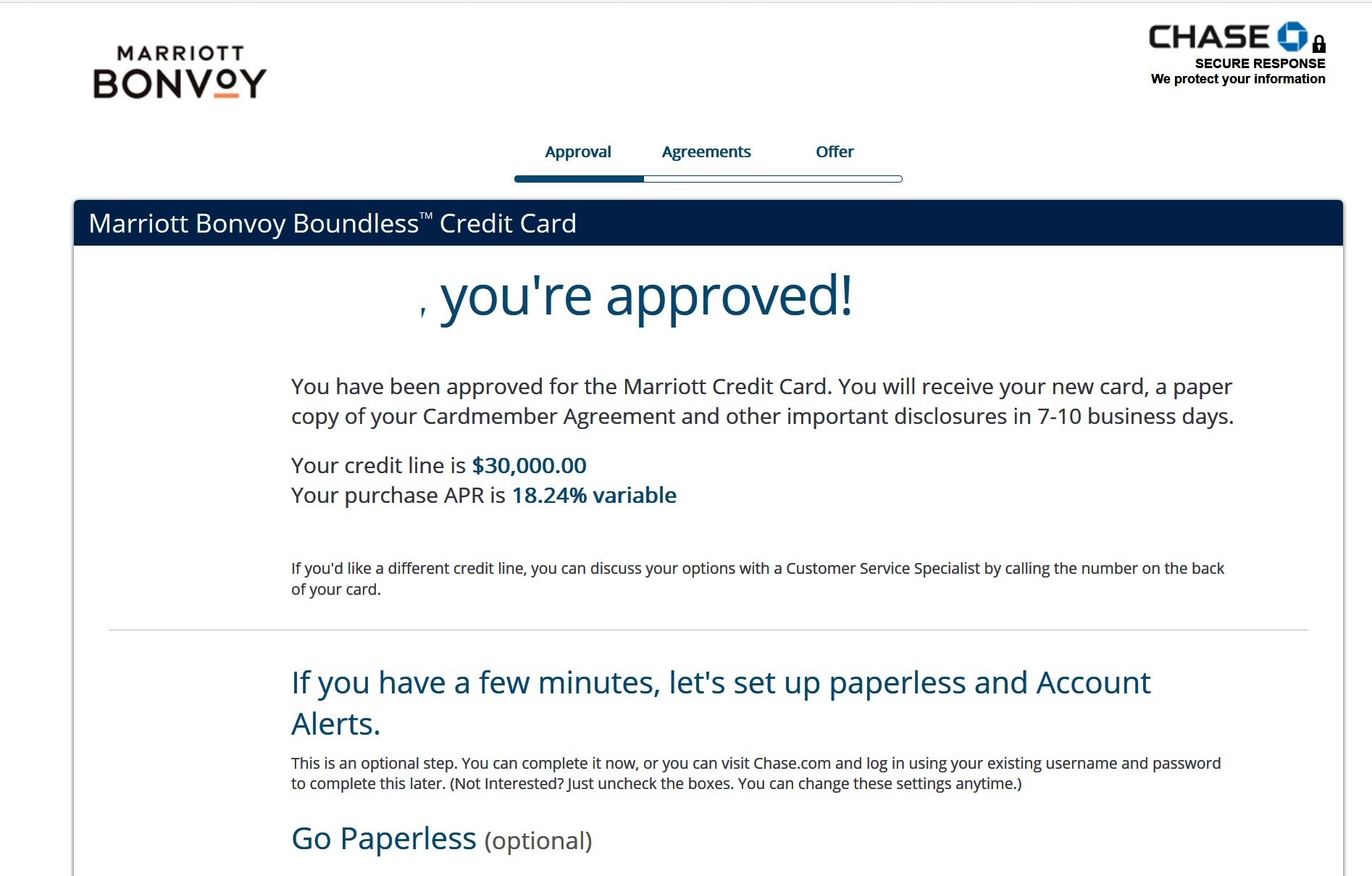

To apply for a married relationship loan you will have to submit to a credit score assessment and you may glance at the typical loan underwriting processes, because you create which have a typical consumer loan. The better your own borrowing, the lower the Annual percentage rate (Apr) might possibly be. Your wedding day financing will have that loan term. Brand new conditions are usually up to three years however some is because long since the 84 days.

Definitely, some people want to costs wedding sales on the playing cards though signature loans generally have down interest rates than handmade cards. One which just place your matrimony expenditures on the plastic, it will be best if you speak about consumer loan selection here are the findings. While you are up against monetaray hardship or issues, you happen to be capable qualify for a wedding grant one will allow you to build your relationship hopes and dreams come true.

Is Matrimony Money sensible?

For folks who as well as your required along with her features a couple good, middle-to-high earnings, repaying a marriage financing tends to be simple. Yet, if your earnings would be the fact high, why don’t you hold off and you can cut back for your matrimony? Considercarefully what otherwise you can certainly do with the currency you would devote to desire costs getting a marriage financing.

If you don’t have the sort of revenues who create trying to repay a wedding mortgage down, investing a loan was economically harmful. The same goes getting couples that already carry many financial obligation. Got a home loan, car loans and/otherwise student education loans? In this case, you need to think carefully prior to taking towards significantly more debt.

Any your position, it’s really worth examining relationships capital alternatives that won’t make you in the loans. Is it possible you keeps an inferior, more reasonable marriage? Do you really delay the marriage time to give yourselves additional time to store up? Nevertheless perhaps not confident? Studies suggest a correlation between high-cost wedding receptions and better divorce proceedings costs. A moderate occasion may be the best thing for the financial accounts and your dating.

If you decide to sign up for a wedding financing you could want to consider matrimony insurance coverage. For some hundred dollars, a marriage insurance plan have a tendency to refund your in case your place happens broke, a disease delays the nuptials otherwise their photography seems to lose all of your current images. While using financial risk of buying a wedding that have a loan, this may sound right purchasing oneself a tiny comfort of mind having a wedding insurance plan.

It is advisable to look around to make certain that you happen to be having the top deals on both the loan and also the insurance rates plan. Cost vary generally. Knowing you have sometime in advance of you’ll need to acquire the cash, you can begin concentrating on thumping up your credit history. Check your credit history getting errors, create to your-day payments and maintain your own credit utilization ratio at the or below 30%.

Summation

We are inundated with pictures regarding pricey wedding receptions in our people. It’s not hard to ingest the message the only wedding really worth with is just one you to definitely vacations the financial institution. You might think staying one thing more compact (or perhaps affordable). It is likely that your wedding day is not the last large costs you’ll deal with due to the fact one or two. Imagine how will you pay for property purchase, kids’ educational costs and you can advancing years for individuals who start off the matrimony if you take into an enormous amount away from debt.

Skriv et svar