Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

€ 18.50 · 4.9 (539) · In Magazzino

:max_bytes(150000):strip_icc()/soleproprietorship-Final-578020d8a89e486180a235fe9e76c9e9.jpg)

A sole proprietorship or sole trader is an unincorporated business with a single owner who pays personal income tax on business profits.

Why You Should Turn Your Sole Proprietorship into an LLC

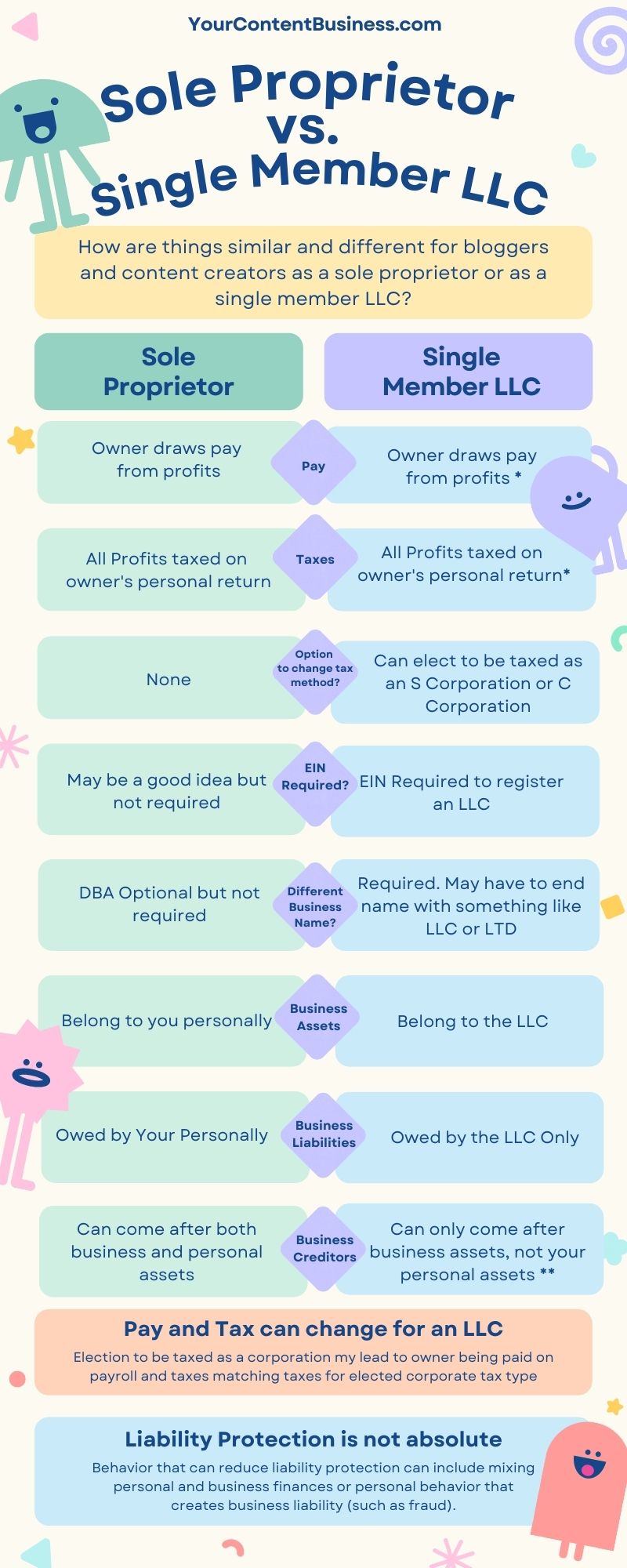

Should My Blog be an LLC? (Business Types for Bloggers)

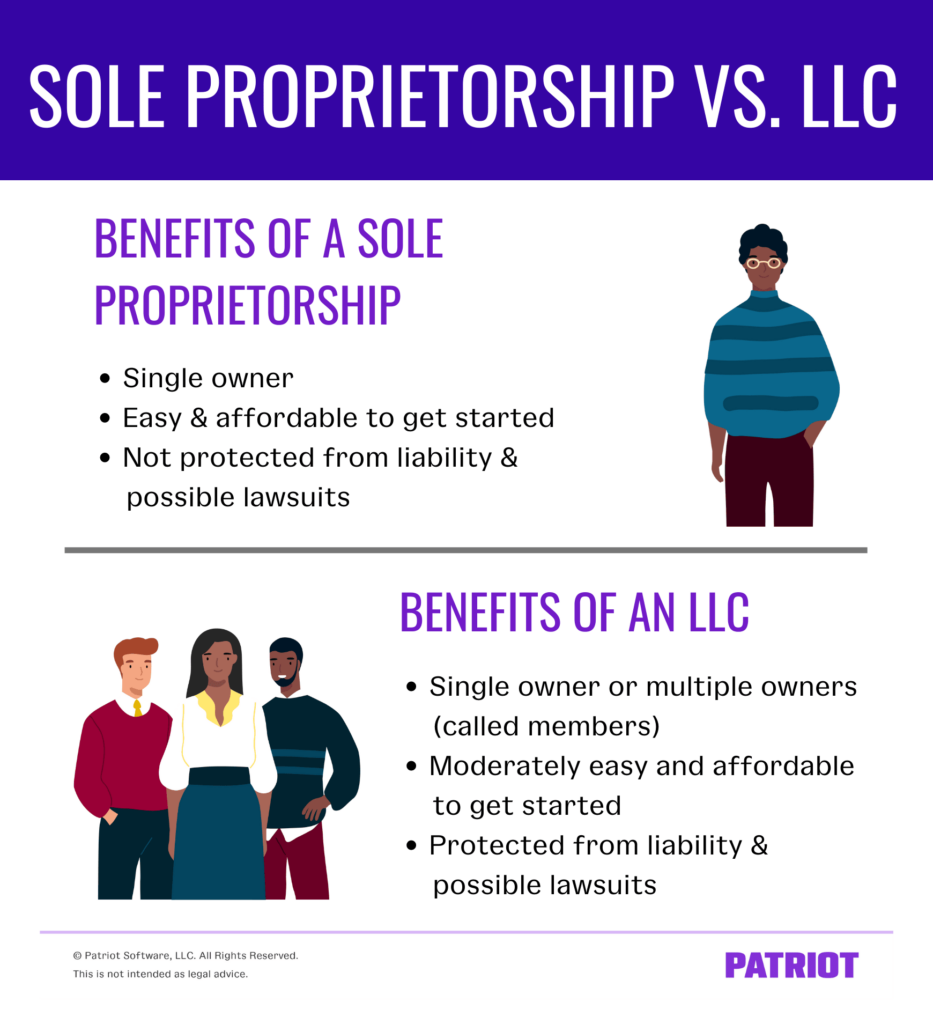

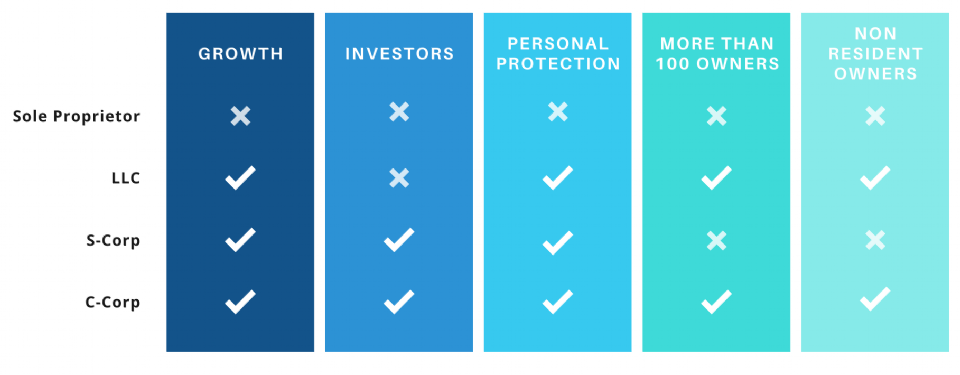

Which is Best for Your Business: Sole Proprietorship vs. LLC?

How to Form an LLC - Advantages & Disadvantages

LLC vs Sole Proprietorship: The Complete Comparison

Sole Proprietorship vs LLC for Your Online Business

Sole Proprietorship to LLC: 9 Steps to Convert a Construction Business

LLC, Sole Proprietorship, or Corp for a Startup?

![]()

Should a Freelancer Form an LLC? - Sole Proprietorship vs LLC

Choosing a Business Structure, Illinois Small Business Development Center